Connors Investor Services has been based in and around Reading, Pennsylvania, constructing individual investment solutions for clients of all sizes, since 1969. Our Options-Based strategies and Small Companies portfolios allow our boutique-sized firm to stand out in a busy investment crowd

Connors Investor Services has been based in and around Reading, Pennsylvania, constructing individual investment solutions for clients of all sizes, since 1969. Our Options-Based strategies and Small Companies portfolios allow our boutique-sized firm to stand out in a busy investment crowd.

We are proud to call home a place where hard work and community values continue to be a priority. In earlier days, famous for its Reading Railroad, the city of Reading relied heavily on trains for transportation. When you look at a busy station’s chaotic web of complicated routes, going in seemingly endless directions, it’s amazing that more trains don’t derail, or send you traveling down the wrong way. To prevent that, the historically strong and sound “rail switch” determines whether a train stays on its current path, or safely begins in a new direction.

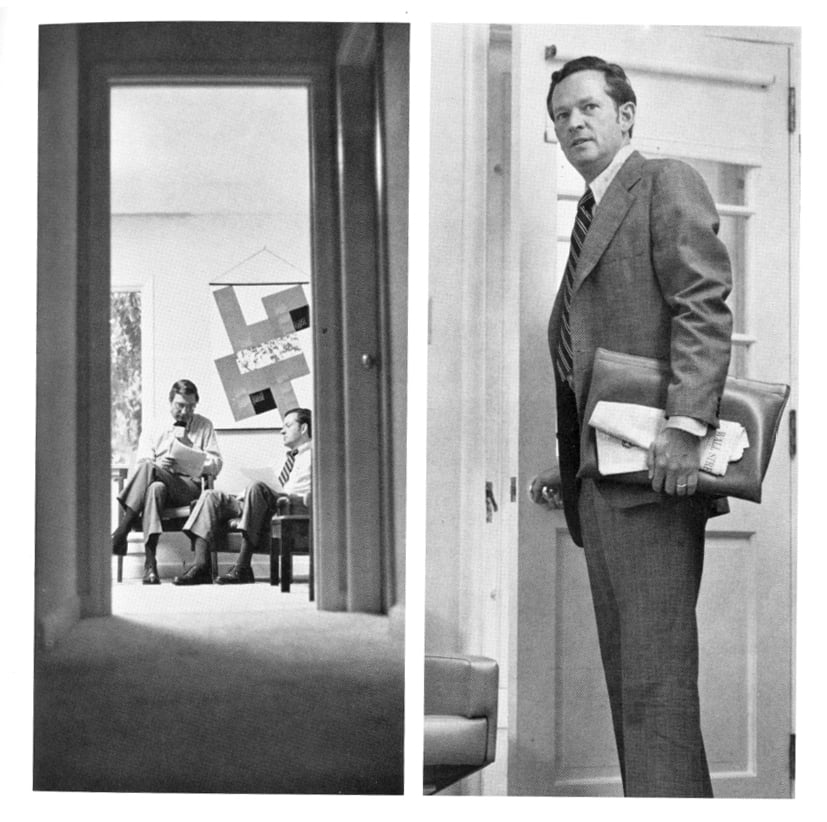

Connors Investor Services was founded in 1969 in Reading, Pennsylvania, as a Registered Investment Advisor (RIA). Jim Connors, earned his B.A. in economics at Princeton University in 1954 and his MBA degree at the Harvard Business School in 1956. Mr. Connors was a strong advocate of writing covered calls on common stock since the beginning of the Chicago Board Options Exchange (CBOE®) in 1973. "The Connors Option Service" was one of the first options research publications produced exclusively for investment advisory firms throughout the United States.

Before starting Connors Investor Services, Jim had a career to be proud of with Carpenter Steel (now Carpenter Technology, a well-regarded specialty steel manufacturer). He had quickly risen through the ranks and was an assistant vice president before starting his company in 1969. Unlike most investment firms, investment management was only a small portion of the Connors business model. While the company managed a few portfolios, Connors primarily pursued research on small company stocks and sold its expertise to individuals and brokerage firms around the country. Jim circulated six publications a year with about 1,200 subscribers. As its publications became validated and recognized on a national basis, Connors received requests for exclusive research from larger, notable national investment firms.

Jim found his firm’s distinguished niche in options after reading Beat the Market: A Scientific Stock Market System by Edward Thorp, originally published in 1967. One of the earliest explorations of hedging in the equity market, Thorp’s work recommended selling expiring warrants against stock holdings, like a covered call position. Jim implemented the concept immediately and was so active in options research and trading that he attended the opening of the Chicago Board Options Exchange (CBOE®) in 1973.

Connors discontinued publishing "The Connors Option Service" in 1977 after recognizing its investment management client base had increased, needing more attention and focus. By this time, the firm had solidified its role in options trading and was recognized across the U.S. as an experienced manager for portfolios with stock options. At one point, Connors had more clients in Texas than in Pennsylvania!

Our best tool to recruit new business has always been word of mouth, even in the early days... The key to our success is a team of people who are capable and experienced, which allows them to deliver the kind of service that we can be proud of.” - James M. Connors

We begin every new relationship the same way: We invest the necessary time to sit with you, face-to-face or over video/phone to get to know and understand your specific ambitions before we invest your money to help you achieve your goals.

We are proud to call home a place where hard work and community values continue to be a priority. In earlier days, famous for its Reading Railroad, the city of Reading relied heavily on trains for transportation. When you look at a busy station’s chaotic web of complicated routes, going in seemingly endless directions, it’s amazing that more trains don’t derail, or send you traveling down the wrong way. To prevent that, the historically strong and sound “rail switch” determines whether a train stays on its current path, or safely begins in a new direction.

At Connors Investor Services, we work tirelessly to guide our clients down the investment track that they are trying to travel on, striving to act as their investment “rail switch” when it comes to staying on their intended path. Our commitment is to do our very best at designing, constructing and implementing an investment track for YOU and not the same blueprint for everyone. Whether you live here locally in the Reading region, or elsewhere in the country, let our investment strategies and experience build and help keep you on the right track.

Thank you for considering Connors Investor Services. We are here and ready to serve you.

When we build a tailored Separately Managed Account for you, we will consider a mix of various investments to incorporate, so we may construct what we believe is the best solution to achieve your goals. At Connors Investor Services, we have been managing our strategies in the form of Separately Managed Accounts (SMAs) since 1974. Although managing each client’s account as a standalone is a much more time consuming process, we believe the benefits of the SMA for the more affluent investor are too large to ignore. In our SMAs, every management decision in the account is made in your best interest because your investment track is our only focus.

SMA owners can customize their holdings by excluding and including certain securities or industries. A client may, for example, wish to screen for tobacco or defense stocks or desire us to hedge their stock holdings with some protective puts. In the end, we try to manage a portfolio that is the best fit for our investor’s needs.

Although mutual funds offer the masses an affordable mechanism for achieving portfolio diversification with management expertise, often investors are not certain what they own or how fees are calculated. At any point with an SMA, you will know what shares you actually own and will have a cost basis for each position. Also, your fee will be clearly defined and you will see all trades that take place.

SMA holders pay taxes only on the capital gains they actually realize and are able to harvest gains and losses that best fit their financial situation.

Health care expenses are one of the top retirement concerns of people over age 50. Despite that fact, few pre-retirees have estimated how much they need to save for health care costs in retirement.*

Q: How many pre-retirees have estimated the cost of future healthcare expenses?

Outliving their savings can be a huge retirement concern for people nearing retirement. Working part-time for even just a few years may help them suspend drawing income from Social Security and savings while taking advantage of available pensions and benefits.*

Q: What percentage of 65-year-olds are in the workforce

Today, nearly 25% of all 65-year-olds will live to age 90, according to the Social Security Administration. Reduce retirement anxiety by estimating how much you’ll need to save to cover a long retirement.*

Q: What percentage of baby boomers have nothing saved for retirement?

Regardless of your full Social Security retirement age, which ranges from 65 to 67, you can collect retirement benefits as early as age 62 as long as you’ve paid into the program for at least 40 quarters or about 10 years. (Widows and widowers can collect survivor benefits at 60.) However, for each year you delay, your benefit increases by about 8% until age 70. So does it pay to wait?”*

Q: What percentage of retirees take Social Security at age 62?

*Source: Investopedia

Connors Investor Services, The Smart Option, since 1969

Years that Connors has been in business

Dow Jones Industrial Average in 1969

Dow Jones Industrial Average at the end of 2020

Beyond this point, the information provided is intended for investment professionals only. Please read these conditions carefully before using this site. By using this site, you signify your assent to the following terms and conditions of use without limitation or qualification. In particular, you consent to the use of all cookies on this website for the purposes described in the terms of use. If you do not agree to these terms or to the use of cookies as described below, do not use this site. Connors Investor Services may at any time revise these terms of use. You are bound by any such revisions and should therefore periodically visit this page to review the then current terms of use to which you are bound. This site is for informational purposes and does not constitute an offer to sell or a solicitation of an offer to buy any security which may be referenced herein.

This site is solely intended for institutional investors or institutional consultants, licensed investment advisors, or qualified purchasers.

Do you wish to continue?

You are no leaving the Connors Mutual Fund website and entering the Connors Investor Services website.

You are no leaving the Connors Mutual Fund website and entering the Connors Investor Services website.

You are now leaving Connors Investor Services website and entering the Connors Mutual Fund Website.

You are now leaving the Connors Mutual Fund website and entering the Connors Investor Services website.

You are no leaving the Connors Mutual Fund website and entering the Connors Investor Services website.

You are no leaving the Connors Mutual Fund website and entering the Connors Investor Services website.