The objective of the Small Companies strategy is to provide returns greater than that of the Russell 2000® over a market cycle.

In the early 1970s, the firm’s principal business activity was publication of “The Connors Report,” a research report on emerging small company growth stocks, which, at its publication peak, had over 1200 national subscribers consisting of brokerage firms and individual advisors.

Connors began managing small company portfolios in 1974. The Small Companies strategy is based upon two, long-held fundamental beliefs:

1. First, that small capitalization equites will continue to be among the highest long-term return asset classes of publicly traded securities.

2. Second, Connors Investor Services, Inc. believes in the ability to capitalize on market inefficiencies through fundamental research due to a lack of broad research coverage by the analytic and institutional community.

The Connors proprietary investment thesis has been continued over the history of the firm. Sine 2004, current portfolio manager, Brian G. McCoy, has been leading the small companies strategy.

The aim of the strategy, which has been a specialty of Connors since our founding in 1969, is to provide returns greater than those of large company stocks.

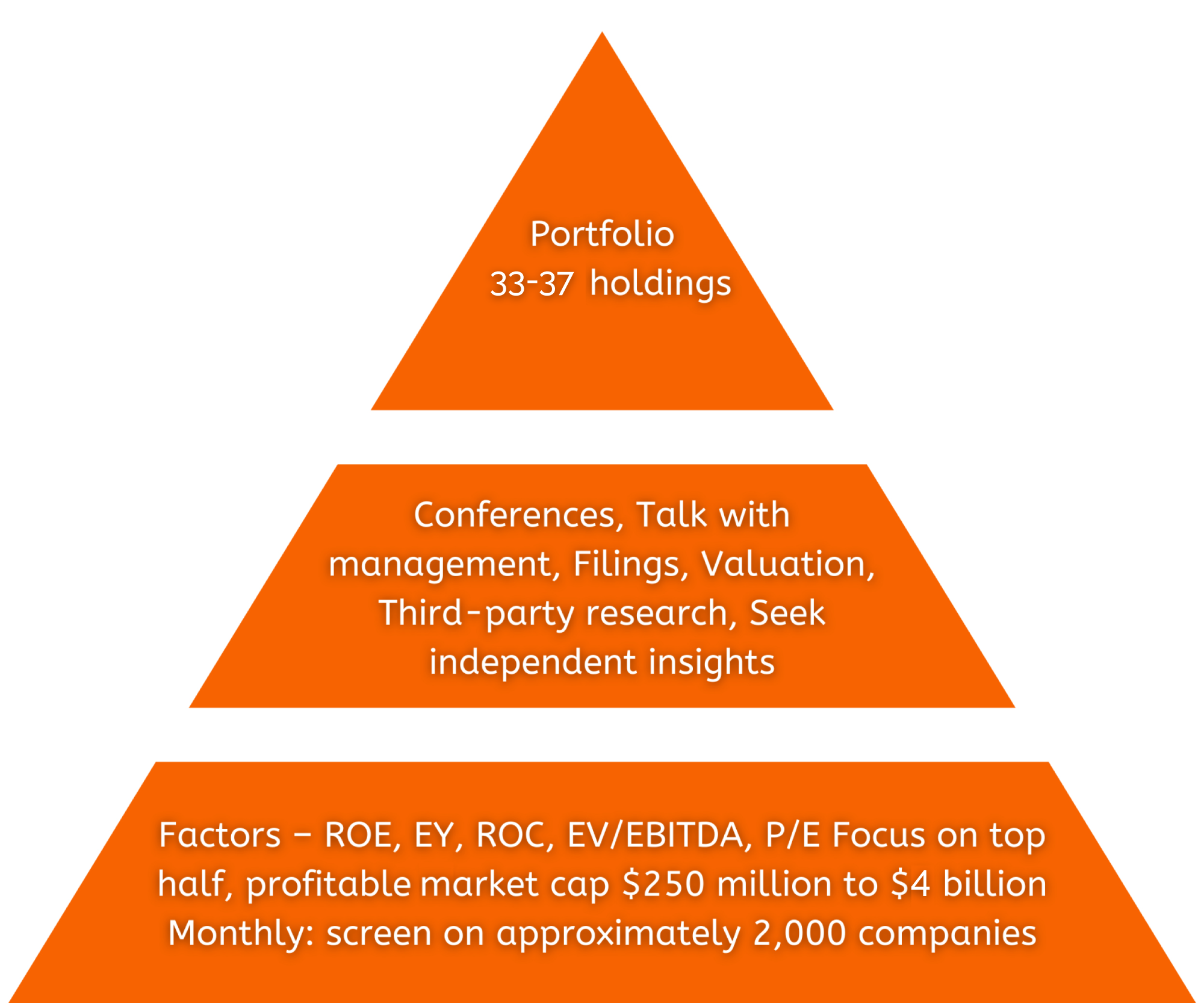

Our search begins with in-house database screening which narrows our field of focus. The results are utilized to guide our bottom-up, company level research that combines research conferences, meetings with management, third-party research and company filings. These efforts result in a proprietary return analysis and report.

Beyond this point, the information provided is intended for investment professionals only. Please read these conditions carefully before using this site. By using this site, you signify your assent to the following terms and conditions of use without limitation or qualification. In particular, you consent to the use of all cookies on this website for the purposes described in the terms of use. If you do not agree to these terms or to the use of cookies as described below, do not use this site. Connors Investor Services may at any time revise these terms of use. You are bound by any such revisions and should therefore periodically visit this page to review the then current terms of use to which you are bound. This site is for informational purposes and does not constitute an offer to sell or a solicitation of an offer to buy any security which may be referenced herein.

This site is solely intended for institutional investors or institutional consultants, licensed investment advisors, or qualified purchasers.

Do you wish to continue?

You are no leaving the Connors Mutual Fund website and entering the Connors Investor Services website.

You are no leaving the Connors Mutual Fund website and entering the Connors Investor Services website.

You are now leaving Connors Investor Services website and entering the Connors Mutual Fund Website.

You are now leaving the Connors Mutual Fund website and entering the Connors Investor Services website.

You are no leaving the Connors Mutual Fund website and entering the Connors Investor Services website.

You are no leaving the Connors Mutual Fund website and entering the Connors Investor Services website.